Everyone knows that the Baby Boomers (born between 1945 and 1964) were the generation that had it all, sucking up and wasting all the world’s resources, leaving nothing for their ancestors. Everyone knows that Baby Boomers had it easy when it came to housing. Everyone knows they enjoyed low-cost, manageable mortgages while the younger generation struggles to afford hovels. But don’t blame Boomers. Blame Millennials for their good fortune.

The generation that has benefited the most from historically low mortgage rates is (suprise!) the Millennial generation (born between 1981 and 1996). Mortgage rates experienced a significant decline in recent years, and this has had a substantial positive impact on the affordability of homes for millennials.

- Timing: Millennials came of age and entered the housing market during a period when interest rates were at historic lows. In the aftermath of the 2008 financial crisis, central banks worldwide implemented policies to keep interest rates low to stimulate economic growth and recovery. This low-rate environment has persisted for an extended period, benefiting millennials who began buying homes in the late 2000s and 2010s, up until the early 2020’s.

- Refinancing Opportunities: Millennials who already owned homes before the rate drops were able to take advantage of refinancing opportunities. By refinancing their mortgages at lower rates, they could reduce their monthly payments, freeing up more money for other financial goals.

- Down Payments: Today, young people often complain about the three percent down payments required to step into the housing market. Well, Baby Boomers weren’t exempt from this challenge either. Except in their era, down payments were typically 20% of the home’s value.

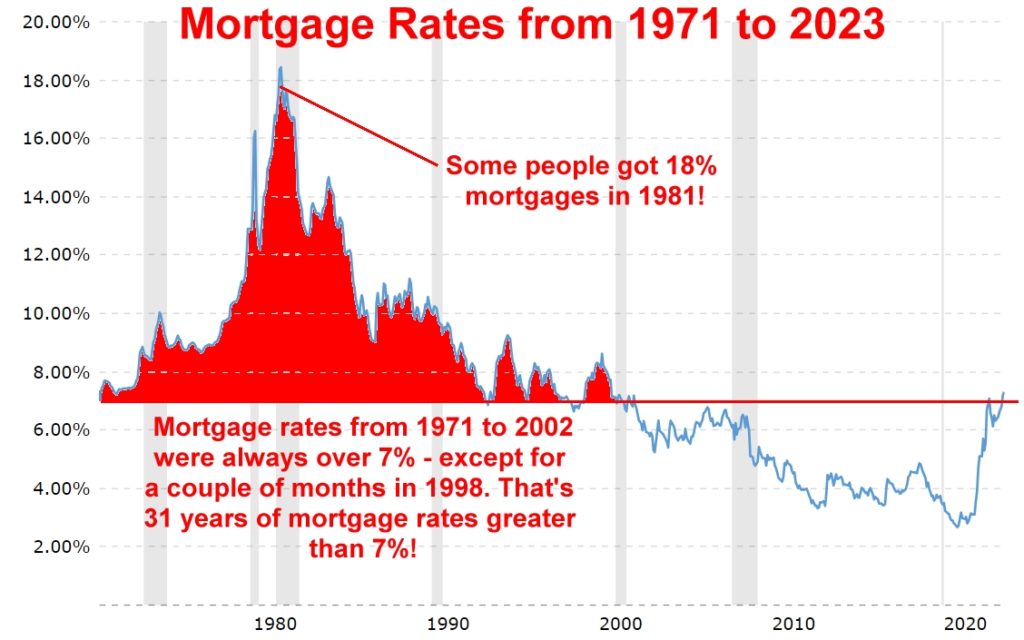

Baby Boomers, faced significantly higher mortgage rates during their home-buying years. They purchased houses from about 1970 to about 1995. Interest rates reached 18% during the 1980s, which meant that the cost of borrowing for a home was substantially higher compared to what millennials and other generations have experienced. Repeat: some Baby Boomers had 18% mortgages in the 1980’s!

Just take a little look at historical mortgage rates below. It will be clear as to which generation you should direct your jealousy. The Millenials are the only group that ever got a shot at three percent mortgages! Don’t blame Boomers.

The first chart covers the period from 1971 to 2023. Note the Baby Boomer buying period from 1971 to about the year 1995. A quick look verifies that Baby Boomers were paying an average of about ten percent during this period. Some Boomers had rates from 12 percent to 18 percent!

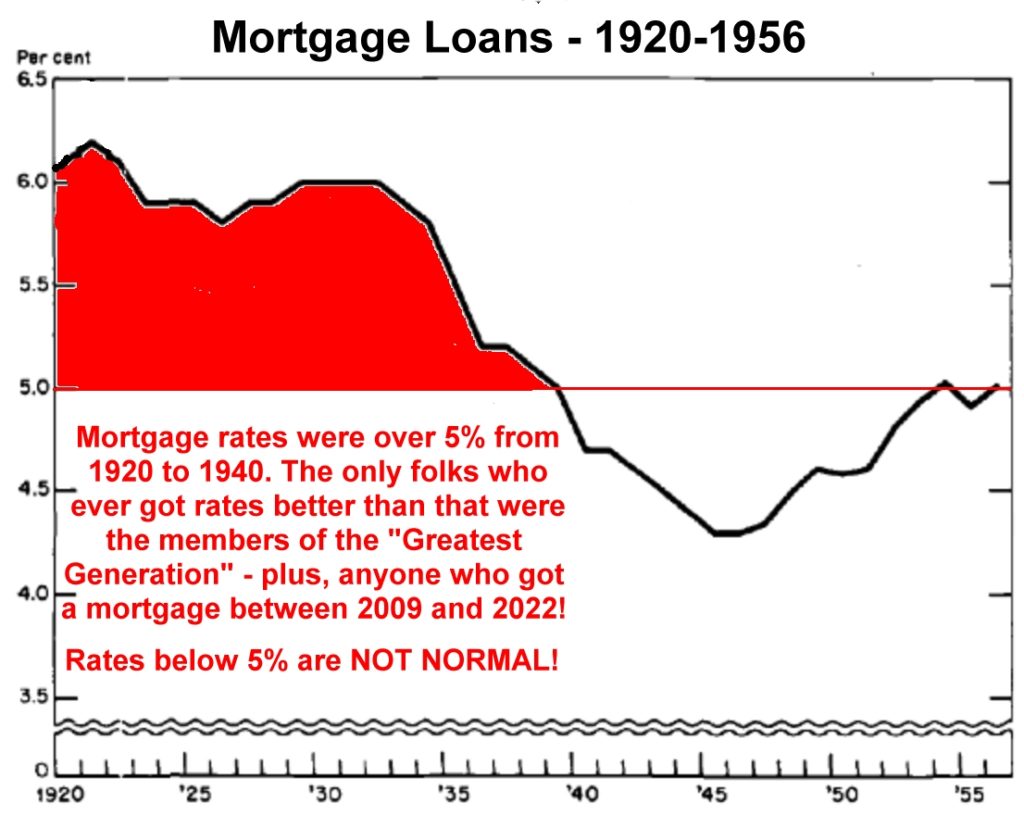

Date on mortgage rates before 1971 is a little more scarce. But there is some. Note the following chart, which covers the years from 1920 to 1956. Mortgage rates averaged about six percent up until the mid-1930’s. Of course, this period includes the Great Depression, from 1929 to 1940, when very few people could afford to buy a house, anyway.

The best period on this chart was from 1940-1956, when mortgages averaged 4.5%. This time period benefited the ‘Greatest Generation’…the parents of Baby Boomers. By the late 1960’s mortgage rates had again risen to about seven percent. And Boomers were out in the cold, so please don’t blame Boomers.

So, a quick look at the data shows that rates below five or six percent are not historically normal. And, of all the recent generations, Baby Boomers had it the worst!